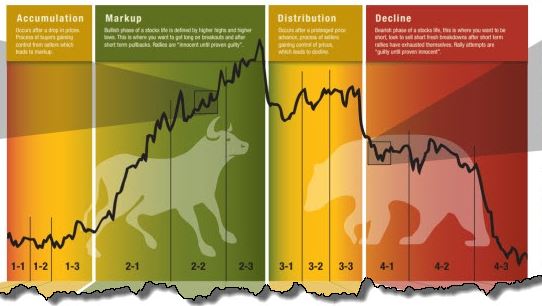

Market Structure Phases

When I was learning technical analysis I remember just focusing on the daily charts and ignoring other timeframes. Furthermore, I would just be looking at the series of candles to find a bullish engulfing, morning star, or piercing candle just to name a few without actually looking at the bigger picture. I ended up bag holding a lot and not realizing I was buying near the top of the current trend; or the distribution phase as it is called. I picked up a book called “Technical Analysis Using Multiple Timeframes” by Brian Shannon, from Amazon, and although it was pricey it explained the different phases for a stock. In addition, he also explains the psychology of what is happening with the market participants during each stage and why the price action is as it is. In this article I will be using Nutanix(NTNX), a stock I’m currently bag holding as of 7.28.19, to explain the phases of the stock.

Stage 1: Accumulation

This stage occurs after prices drop from a much higher level. It its the phase in which the buyers push back against seller to regain control of the stock and prevent it form falling any further.

In the early transition stage from declining to neutral the longer term moving averages are still declining. The stock will cross above and below the averages; once they catch up.

In the middle part of the accumulation stage buyers will hold a floor on the price and accumulate; however, there is no momentum to propel the stock.

The later/last phase of the accumulation stage buyers start buying up the stock making new higher lows on the price but sellers prevent the resistance level from being broken. The moving averages will become flat.

Stage 2: Markup

This stage occurs after the resistance from the accumulation stage has been broken and the sellers back off. This is the stage you want to get long on the breakout retest or pullback to a short term moving average. You must want to see higher highs and higher lows. Momentum will kick in and stock will keep advancing higher.

In the first part of stage 2 you should see a sharp upside momentum along with higher highs and higher lows. The short term moving averages should advance sharply.

In the middle part of stage 2 pullbacks will occur often with sharp selloffs where price falls towards a short term moving average. It should find some buying support only to resume the markup shortly after.

The final stage of markup you will see that the momentum is there but fading as it is taking longer to advance higher after pullbacks occur. Gains occur after early short sellers become trapped by shorting too early or via some news catalyst.

Stage 3: Distribution

This stage is simple to understand as the price has advanced higher it is now time for longs to lock in profits and shorts to come in heavy. The shorts are now fighting for control and sellers also cause resistance.

In the early stage the short term moving averages start curving towards the downside and being to cross each other.

Shortly after the stock becomes more neutral as there is not as much momentum to lift it towards the upside as short term traders start to bail. It is still possible for stocks to go higher if there is the right catalyst; however, at this stage it is most likely to stay neutral or any pop to be sold off.

The later stage the short term moving averages start heading south and acting as resistance. The key support level is still there but begins being tested more and more.

Stage 4: Decline

This is the bearish stage of the cycle and is where you want to short every breakdown of support levels.

In the first part of the phase you begin to see a pattern of lower highs and lower lows. The stock is beginning to show some signs of short term death and could drop sharply very fast.

In the middle part of this stage any rally towards the moving averages fail and the stock gets sold off. It struggles to make higher highs.

The final stage of this phase you see short term support being broken and price fall drastically until it can find a strong level where bulls come in to buy the stock. When bulls do come in you return to stage 1 and repeat the cycle.